In the near-term planning, in terms of tracking battery, charging and vehicle planning, some smart cockpit and automatic driving technology tracking status will also be added. A very interesting point is that, with the introduction of the flagship version of pure electric, European and American car companies have combined various cockpit and autonomous driving technologies with the flagship version of pure electric, which means that they can be based on the comprehensive capabilities in several directions. Judge the combat effectiveness of the model. Of course, the battery is still a very basic part, and it is worth tracking and summarizing every month. I would like to optimize the content including: car display, domain controller and perception technology.

Remarks: Some of the content can be obtained through filing and some hardware information can be obtained from the hardware design level.

Figure 1 The platform that tracks the launch of the entire vehicle can be broken down and analyzed by technical blocks.

The first part of the domestic battery industry in May

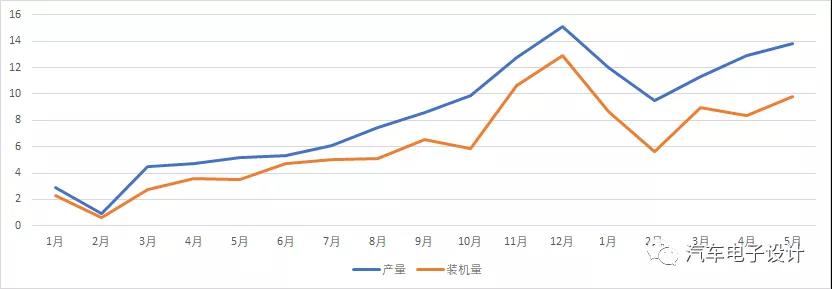

In May, the output of power batteries was 13.8GWh, and the installed capacity of batteries was 9.8GWh. The difference of 4GWh continues to be maintained here. From the current point of view, there will always be a difference between the domestic installed capacity and the actual output.

Figure 2 The difference between power battery production and installed capacity.

SNE gave an answer here, that is, CATL (Tesla Model 3 (exported from China to Europe), Peugeot e-2008, Opel Corsa) and BYD’s overseas installed capacity. According to SNE’s data, that means two The cumulative total is 3.8GWh, which explains the difference of 14GWh from January to April, and 1/3 is used overseas.

Remarks: In the first five months, the cumulative output of power batteries was 59.5GWh, the cumulative installed volume was 41.4GWh, and the cumulative 18.4GWh. It is estimated that half of these are temporarily stored in the warehouses of battery companies and car companies to meet the demand gap in the second half of the year.

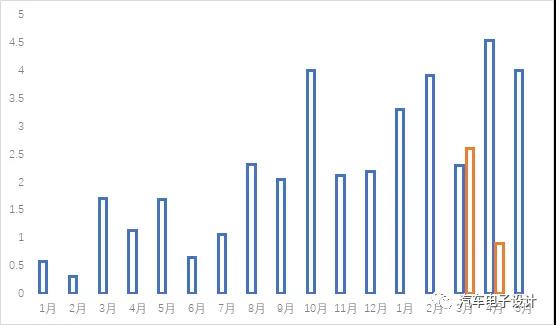

Figure 3 Domestic production-installed capacity difference and overseas installed capacity given by SNE.

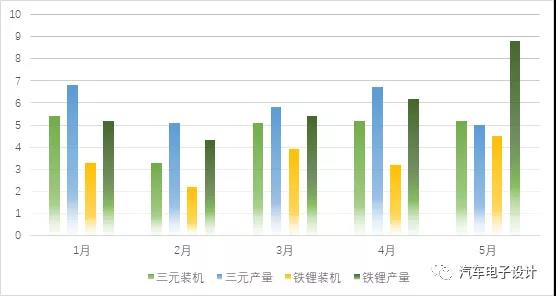

At present, there is another important feature, which is the situation of lithium iron phosphate:

1. From the data point of view, the output of the li-ion battery is 5.0GWh, accounting for 36.2% of the total output, a decrease of 25.4% from the previous month; the output of lithium iron phosphate batteries is 8.8GWh, accounting for 63.6% of the total output, an increase of 41.6% from the previous month. The total installed capacity of li-ion batteries was 5.2GWh, an increase of 1.0% month-on-month; the total installed capacity of lithium iron phosphate batteries was 4.5GWh, an increase of 40.9% month-on-month.

2. From the actual situation, the output of iron-lithium has exceeded the installed capacity for several consecutive months. On the one hand, it reflects that this part of the difference should be the main force of exports, and another possibility is that the subsequent demand and installed capacity of iron-lithium will be very large. . Because the current output of Sanyuan is relatively stable.

From March to May, the three-month li-ion installed demand has stabilized at 5GWh, and the installed demand for iron-lithium has also increased rapidly.

Judging from the current situation, it may indicate that the next wave of existing models may have an entry-level iron-lithium version, or that many car companies are switching. The optimistic expectations for growth in the second half of the year should be largely built on the rapid increase in iron and lithium, which can bring further declines in car prices and expand the scale of demand. To put it simply, price cuts and momentum in passenger cars rely on iron-lithium cutting, and the increase in production also proves that this piece will be put into production faster.

Figure 4 Production and installed capacity of iron-lithium and li-ion

Judging from other data, the follow-up requirements for iron-lithium in special vehicles and buses have also been put forward. From the perspective of comprehensive electrification in various fields, the demand for iron-lithium is soon higher than the three yuan. In the next few months, the increase in other areas also increased the demand for iron and lithium.

Figure 5 Classification of installed capacity during this period.

From the overall situation in 2021, the cumulative output of ternary batteries from January to May is 29.5GWh, accounting for 49.6% of the total output, a cumulative year-on-year increase of 153.4%; the cumulative output of lithium iron phosphate batteries is 29.9GWh, accounting for 50.3% of the total output, a cumulative year-on-year increase of 360.7 %. In the comparison of these two data, we can see the current domestic differences. In the first five months, the total installed volume of li-ion batteries was 24.2GWh, accounting for 58.5% of the total installed vehicles, a cumulative increase of 151.7% year-on-year; the cumulative installed volume of lithium iron phosphate batteries was 17.1GWh, accounting for 41.3% of the total installed vehicles, a cumulative increase of 456.6% year-on-year . Under the guidance of full marketization, the previous ternary solution based on subsidies is not good.

Figure 6 The essence of the original is still based on the subsidies of 1.8 and 13,000, and the coefficients of 0.8, 0.9 and 1 are very low.

Part Two Battery Supplier

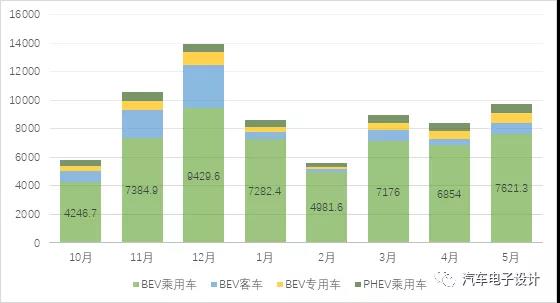

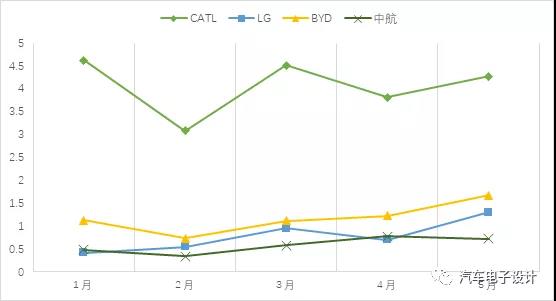

As shown in the figure below, domestic demand is about one super three males. It is really amazing that LG rushed to this position by relying on Model Y.

Figure 7 The situation of domestic battery suppliers

Here is a very interesting point, that is, the amount of Model 3 iron-lithium version can account for about 15% of Ningde.

Remarks: According to Tesla’s domestic insurance data, it is estimated that 10,000 units in May, which is equivalent to 550MWh.

Corresponding Tesla is probably less than 20% under the conditions of domestic passenger car power battery companies (excluding exports). This bargaining power is very amazing.

Post time: Jun-22-2021