out of stock! Price increase! How to build a supply chain “firewall” for power batteries

The sound of “out of stock” and “price increase” continues one after another, and the safety of the supply chain has become the biggest challenge to the release of current power battery production capacity.

Since the second half of 2020, China’s new energy vehicle market has maintained a trend of high growth. In 2021, the market will continue to maintain a high level of prosperity. From January to May, the production and sales of new energy vehicles have increased by 228% and 229% year-on-year, and the market penetration rate has increased to 8.8%.

Driven by the strong market demand, the production capacity of head power batteries has been stretched. The upstream raw materials including lithium salt, electrolytic cobalt, lithium iron phosphate, electrolyte (including lithium hexafluorophosphate, VC solvent, etc.), copper foil, etc. have widened the supply and demand gap, and the price continued to rise. .

Among them, battery-grade lithium carbonate has reached 88,000 yuan/ton, and is operating at a high level. The current market and price are in a relatively stable trend, and the supply is still not loose.

Industry demand for lithium iron phosphate has remained strong since October last year. The price per ton has rebounded from a historical low of 32,000 yuan/ton, and has rebounded to 52,000 yuan/ton, with an increase of 62.5% since the bottom.

Industry data shows that in May this year, the domestic power battery output totaled 13.8GWh, a year-on-year increase of 165.8%, of which the output of lithium iron phosphate batteries was 8.8GWh, exceeding the monthly output of li-ion lithium batteries of 5GWh for the first time this year. It is not ruled out that the output of lithium iron phosphate batteries will surpass that of li-ion batteries this year.

The price of lithium hexafluorophosphate has also soared, hitting a 4-year high. The latest market price has reached 315,000 yuan/ton, an increase of 200% from the beginning of the year 105,000-115,000 yuan/ton, and the price is even closer to the average price of 85,000 yuan in the third quarter of last year. 4 times the ton.

out of stock! Price increase! How to build a supply chain “firewall” for power batteriesAt present, the inventory of lithium hexafluorophosphate industry has dropped to the lowest level in recent years, and some production companies have continued to reach full capacity. Most companies have already saturated their orders in June, and the industry’s operating rate has exceeded 80%.

The price of VC solvent (vinylene carbonate), which directly choked the throat of electrolyte production capacity, rose to 270,000 yuan/ton, an increase of 68%-80% from the average market price of 150,000 to 160,000 yuan last year. There was even a supply gap for a while.

The industry’s judgment is that whether the price of VC solvents will rise further depends on market supply and demand. The current supply gap continues to expand. In the later period, many small and medium-sized electrolyte companies may not be able to get the goods. It is expected that the tight supply of VC will continue until the first half of next year. .

In addition, the rise in copper prices and processing fees also drove up the price of lithium battery copper foil. As of April 25, the average price of 6μm copper foil and 8μm copper foil in lithium battery copper foil rose to 114,000 yuan/ton and 101,000 yuan/ton respectively. Compared with the 97,000 yuan/ton and 83,000 yuan/ton at the beginning of January, an increase of 18% and 22% respectively.

On the whole, the imbalance between supply and demand will continue in the short term. For materials companies, how to ensure the supply of core customers is related to the sustainable development of the next few years. For power battery companies, how to do a good job in supply chain security At the same time, it satisfies the needs of car companies and end customers to reduce costs, and tests the wisdom and strategic research and judgment of their corporate leaders.

In this context, on July 8-10, the 2021 14th High-tech Lithium Battery Industry Summit will be held at the Wanda Realm Ningde R&F Hotel. The theme of the summit is “Opening a New Era of New Energy”.

Over 500 senior executives of the lithium battery industry chain from complete vehicles, materials, equipment, recycling, etc. will gather together to discuss a new era of new energy industry under the goal of carbon neutrality.

The summit was co-hosted by Ningde Times, Gaogong Lithium Battery, and Ningde Municipal People’s Government, and jointly organized by the Advanced Industry Research Institute and Ningde Municipal Bureau of Industry and Information Technology. Co-organized.

Power battery expansion VS material guarantee

In sharp contrast with the shortage of upstream supply, the capacity expansion of power batteries is still accelerating.

According to incomplete statistics, from 2021 to the present, many power battery companies such as CATL, AVIC Lithium Battery, Honeycomb Energy, Guoxuan High-Tech, Yiwei Lithium Energy, BYD and other power battery companies have announced expansions with investment plans of over 240 billion yuan.

It is worth noting that, unlike the expansion in the past few years, this round of power battery capacity expansion has shown obvious characteristics: first, the main body of expansion is concentrated in head power battery companies, and the second is that the scale of expansion is significantly larger, basically with hundreds of The unit is 100 million.

In order to further stabilize the supply of raw materials, power battery companies are also actively participating in the construction of upstream material safety “firewalls”. Among them, it is not limited to self-construction, equity participation, joint ventures, mergers and acquisitions, and signing of long-term orders to lock in the supply and price of raw materials.

Take CATL as an example. CATL directly or indirectly participates in more than 20 upstream material companies, covering areas such as lithium, cobalt, nickel, lithium carbonate/lithium hydroxide, positive and negative materials, electrolytes and additives. Through holdings, mergers and acquisitions, and deep binding to deepen the control of the upstream raw materials of lithium batteries.

In the near future, CATL has also locked in the electrolyte supply of Tinci Materials and the price of lithium hexafluorophosphate through long-term orders and advance payments to ensure the supply of electrolyte production capacity and the stability of prices. For Tinci Materials, the subsequent release of production capacity and market share will also be firmly guaranteed.

On the whole, for battery companies, building a solid material supply chain will help their long-term stable development; for domestic materials companies, they can get orders from leading companies or participate in cooperation with leading companies. Will have more advantages in the next industry competition.

Material companies expand production “big battle”

In order to keep up with the expansion of power battery companies and grasp the huge market opportunities brought about by the global energy transition, materials companies are also actively deploying capacity expansion.

Gaogong Lithium has noticed that since last year, companies planning to start expansion in the field of cathode materials include Rongbai Technology, Dangsheng Technology, Dow Technology, Xiamen Tungsten New Energy, Xiangtan Electrochemical, Taifeng First, Fengyuan Shares, Guoxuan High-Tech, Defang Nano and so on.

In terms of anodes, Putailai, Shanshan, National Technology (Snow Industry), Zhongke Electric, Xiangfenghua, and Kaijin Energy are all stepping up deployment of anode material production capacity and graphitization processing capabilities.

At the same time, Fuan Carbon Materials, Hubei Baoqian, Jintaineng, Minguang New Materials, Longpan Technology, Sunward Intelligent, and Huashun New Energy have also joined the anode material expansion camp.

In terms of diaphragms, Putailai, Xingyuan Materials, Cangzhou Pearl, Enjie, and Sinoma Technology have also announced expansions.

Supply continues to tighten, and lithium hexafluorophosphate is also ushering in a new round of “expansion wave”. Including Tinci Materials, Yongtai Technology, and Duo Fluoride have increased their production capacity of lithium hexafluorophosphate.

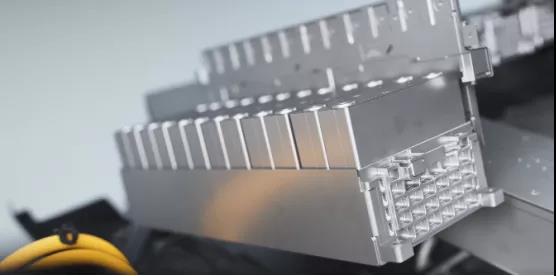

In terms of other materials, the copper foil leader Nordisk, the structural component leader Kodari, and the electrolyte solvent leader Shi Dashenghua are also accelerating the production capacity layout.

What needs to be vigilant is that if materials companies have problems with rhythm matching, delivery capabilities, and quality assurance in cooperation with leading customers, it will have an uncertain impact on their subsequent development.

Therefore, keeping up with the demand and rhythm of power battery head companies will be crucial for the future development of materials companies and will have a profound impact on the changes in the market structure.

Post time: Jul-03-2021